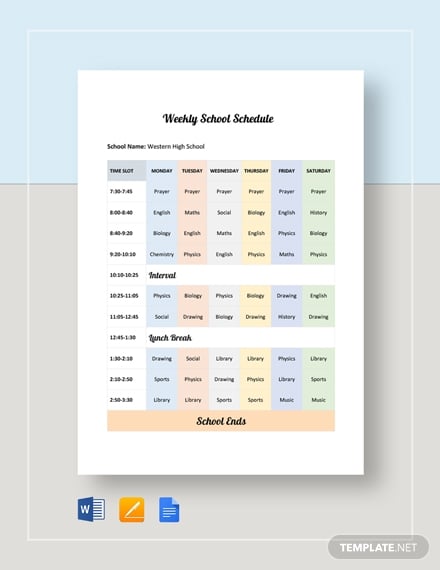

Go to Digital Version and click the Year of Maturity field. The said field may not be linked with Digital version. On Print Version, there may be an error regarding Years of Maturity field. On Carrying amount, change the formula into Copy them into following rows and columns. On Cash Paid column, make sure that the formula is 0.5 come from maturity years which is biyearlyģ. Delete the Expense and Amortization of (Discount) or Premium columnsĢ. However, you can turn it to Straight Line Method:ġ. This bond amortization schedule excel use effective interest method. Bond Amortization Schedule Use Straight Line Method bond amortization schedule straight line method The provided bond amortization schedule calculation can be used for analyzed. So, if you enter unrealistic maturity year, it will only calculate until the maximum period. The bond amortization formula can determine the maximum payment schedule period too. Meanwhile, carrying amount comes from Purchase Price subtracted with Amortization of (Discount) or Premium column. It is not suggested to change the interval.Ĭash Paid come from multiplication between Face Value with Coupon Rate.Įxpense use Effective Rate and Purchase price multiplication for determining the amount.Īmortization of (Discount) or Premium gained after the Cash Paid subtracted with Expense column. Payments period is set on every 6 months, so the Payment schedule will be doubled after the maturity years field. The calculator will automatically calculate the result.

You only need to enter the Information field. It is totally simple to use bond amortization schedule template. Related Template: Cash Flow Projection For 12 Months Templates bond amortization schedule excel effective interest method

The payments period is set on every 6 months. Amortization Calculator: table for displaying the amortization rate in both methods. Effective rate: Actual interest paid on a loan, or earned on a deposit accounts.Ģ.Coupon rate: amount of interest paid per year as a percentage of the face value or principal.Years until maturity: their maturity terms.Face value of bond: nominal value or dollar value of a security stated by the issuer.

The information is for calculating the fields on Amortization Calculator. Information fields: for entering the amortization information. There are only two elements in the sheets:ġ. The other one has light design for printing with more white color, which saves more ink. Both sheets are same, only one has dark design on the spreadsheet. There are two sheets in bond amortization schedule template.

You can turn the bond amortization schedule calculator into depreciation calculator. It can be used regardless of the industry type. The bond amortization excel can be used for small to big company or individuals. Meanwhile, bond amortization meaning is financial certificate that has been reduced in value for recording on financial statements. Meanwhile, depreciation is for tangible and permanent assets. Only, amortization specifies in intangible assets such as brands, patent, and other. In Accountancy, amortization is similar like depreciation.

0 kommentar(er)

0 kommentar(er)